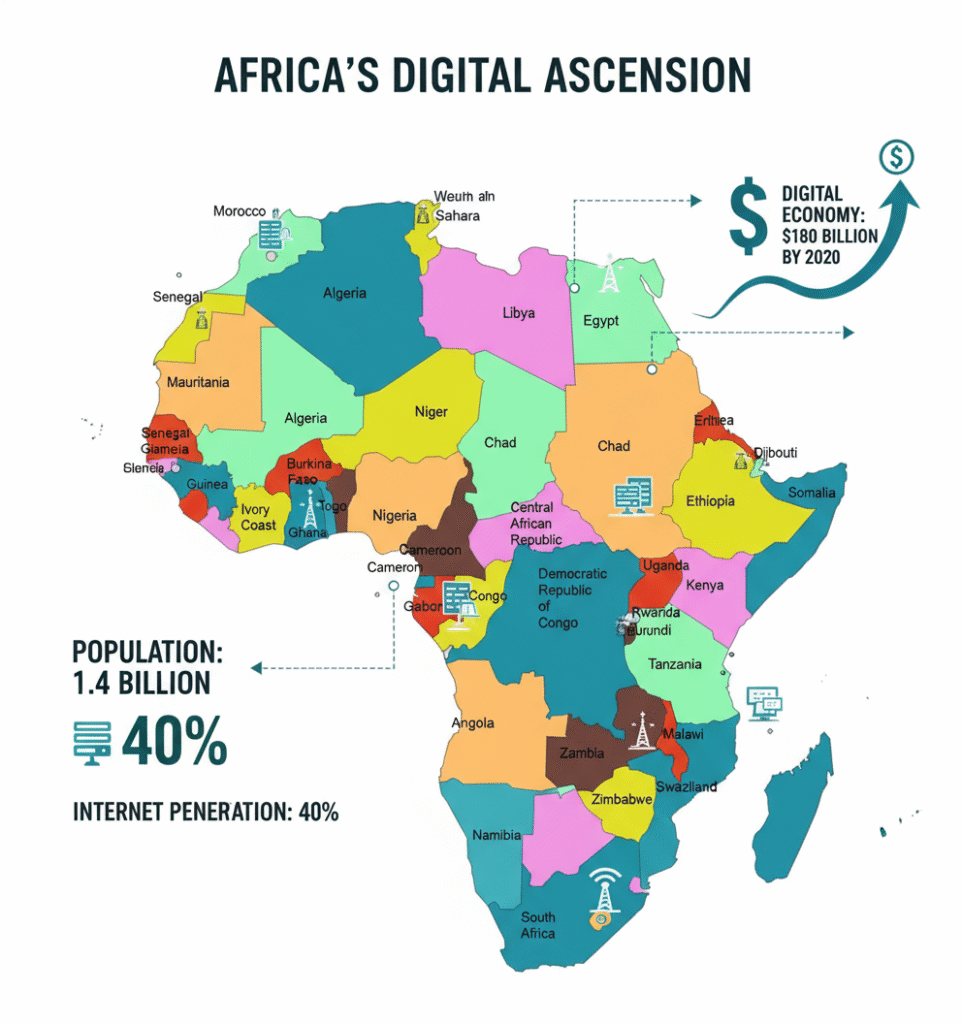

Africa’s got a moment. A real one. Right now, the continent’s undergoing a rapid digital revolution, and its digital economy—projected to reach $180 billion by 2030—has become the new frontier in the global rivalry between the U.S and China.

Think of it like this: two superpowers showing up to an auction with very different bid strategies, and 1.4 billion Africans are watching to see who’s actually offering them something useful.

The Stakes of Africa’s Digital Revolution

This competition is forcing African nations to make increasingly difficult choices about which technology to adopt, which partners to trust, and ultimately, which model of the internet they want to embrace. The core question isn’t just about speed or cost anymore. It’s deeper. It’s about digital sovereignty, about whether a continent shaped by centuries of external control finally gets to write its own tech story.

As the Atlantic Council aptly observed, “the means by which Africans view and see the world will be increasingly shaped by the hardware and software they use—and, perhaps more importantly, to which they have access.” That’s the real kicker. It’s not just about infrastructure. It’s about who gets to shape how Africans see reality itself. Pretty significant, right?

China’s Digital Silk Road: Building Africa’s Network Foundations

China, primarily through state-backed giants like Huawei and ZTE has dominated the physical foundations of Africa’s internet. They went all-in on the “Digital Silk Road,” and they didn’t mess around.

Dominance in Telecom Infrastructure

The Raw Numbers: Chinese companies have built an estimated 50% of Africa’s 3G networks and a staggering 70% of its 4G networks. Between 2000 and 2020, China poured over $13.5 billion into Africa’s ICT sector. That’s not pocket change. Huawei and ZTE have constructed national fiber-optic backbones and e-government platforms for more than 20 African countries. They’re not just selling equipment—they’re becoming essential infrastructure providers, woven into the fabric of how nations operate.

Speed and Cost Advantage

Here’s the thing: China figured out what African governments actually needed, right now. Rapid. Affordable. Comprehensive. A turnkey approach that includes equipment, installation, training, and—this is crucial—financing tied to Belt and Road Initiative loans. No waiting around. No committee meetings. Just results.

For a continent grappling with a massive digital divide (only about 35% of Africans had internet access as of 2021), China’s offer is almost impossible to refuse. Industry analysts have noted that Huawei’s maintained very cordial working relationships with most African governments. They haven’t been swayed by Western pressure campaigns to exclude the company. Why? Because Huawei showed up with money when it mattered.

Historical context: The expansion began with China’s “Go Out” policy in 1999, which encouraged Chinese companies to invest abroad.

Financing: State-backed loans from institutions like the Export-Import Bank of China have been crucial for funding projects.

The Immediate Appeal

Furthermore, China addresses the most pressing need. Getting people connected quickly and cheaply. When a government needs to connect millions of citizens to the internet and actually boost GDP growth, waiting for expensive Western alternatives or trying to develop domestic capacity isn’t realistic. It’s not even close to realistic. Citizens don’t care about governance models if they’re offline.

The U.S. Model: Software, Security, and Private Capital

Why U.S. tech giants target the Cloud, not the cables:

The U.S. took a completely different path. Less “build the pipes,” more “build the ecosystem.”

The United States relies heavily on its private sector (Google, Microsoft, Amazon, Meta) and focuses on the upper layers of the digital stack: software, cloud services, platforms, and venture capital. It’s a bet on innovation rather than infrastructure.

Venture Capital’s the Engine

American private capital drives the African tech startup ecosystem. U.S. investors lead funding rounds in fintech, ed-tech, health-tech, and emerging sectors. They represent roughly 75% of venture capital flowing into African tech markets. But here’s what’s interesting—this isn’t just money. It’s ecosystem building. When venture capital flows in, so do mentors, networks, and knowledge transfer.

Infrastructure Too, But Different

U.S. firms are investing in the 2Africa submarine cable—one of the world’s longest subsea cables—which is expected to double the continent’s total internet capacity. Microsoft, on the other hand, partnered on the Olkaria data center in Kenya. But notice the difference: these projects complement local networks rather than replace them. They’re enablers, not replacements.

Likewise, the Digital Transformation with Africa (DTA) strategy prioritizes building secure, reliable, and interoperable digital infrastructure. This helps ensure that new digital tools and networks adhere to transparent standards and are not vulnerable to foreign manipulation.

Governance and Security Proposition

The Real Bet: The U.S. emphasizes digital trust, data security standards, and transparent governance frameworks. This appeals to nations concerned about surveillance, data sovereignty, and vulnerability to cyberattacks—and honestly, those concerns aren’t paranoia. They’re based on legitimate technical risks.

But here’s the uncomfortable truth: this model requires more initial technical capacity and financial sophistication from adopting nations.

Key focus areas and initiatives:

- Engagement with local frameworks: The U.S. supports African countries in creating and harmonizing their data protection and privacy frameworks. This includes aligning with continental initiatives like the African Union’s Data Policy Framework and individual countries’ legislation.

- Promoting U.S. standards: American agencies like the National Institute of Standards and Technology (NIST) advocate for the adoption of their cybersecurity standards in Africa. This helps protect critical infrastructure and ensures that data is handled securely, which is crucial for trade and business.

- Encouraging interoperability: By promoting common data standards, the U.S. and its partners aim to ensure that data can flow securely and freely across borders. This is vital for digital trade under the African Continental Free Trade Area (AfCFTA).

Transparent governance and democratic values

A central goal of the U.S. strategy is to provide an alternative to the “data-for-surveillance” model often associated with China. The U.S. approach promotes digital governance that protects individual rights and privacy, rather than enabling state control or surveillance.

- Ensuring ethical use of technology: The U.S. emphasizes the ethical use of emerging technologies like artificial intelligence (AI), focusing on transparency, bias minimization, and accountability. This is intended to ensure that technological advancements contribute to equitable socio-economic development.

- Multi-stakeholder approach: The U.S. supports a multi-stakeholder model of internet governance, involving governments, civil society, the private sector, and academia. This inclusive approach is seen as more transparent and effective than government-led models.

The Strategic Vision

The U.S. offers a model based on free-market innovation, private sector-led growth, and technological standards aligned with Western data protection and cybersecurity norms. However, this model requires more initial technical capacity and financial sophistication from adopting nations.

- Differentiate from rivals: Provide a clear contrast to China, whose approach to digital infrastructure is often criticized for lacking transparency and potentially facilitating surveillance.

- Protect U.S. interests: Ensure that digital standards and regulations in Africa are compatible with those in the U.S., which facilitates trade and strengthens economic ties.

- Promote long-term stability: Support the development of open and secure digital societies that are more resilient to destabilizing factors, both digital and political.

The Clean Network Initiative: Why it Faltered in Africa

The U.S. government decided to make a move. The Clean Network Initiative was supposed to be the counter-offensive—create a coalition of “trusted partners” that’d refuse to use Chinese technology, especially Huawei’s 5G equipment, citing security and privacy risks.

On the surface? Smart thinking. The U.S. intelligence community’s 2025 Annual Threat Assessment explicitly warned that China possesses the capabilities to disable or degrade critical infrastructure—including telecommunications systems—as a coercive tool in future conflicts. That’s not theoretical. That’s a genuine risk assessment from people whose job is to worry about this stuff. The risks of embedding potentially exploitable technology in a nation’s core digital infrastructure are real.

But here’s where it gets complicated.

The initiative actually worked in parts of Europe, where governments had the financial resources and technical capacity to transition away from Chinese vendors. Africa? Different story entirely. The impact’s been notably limited, and there’s a reason why.

Why African Nations Said No

Most African countries viewed the Clean Network Initiative as forcing them to take a side in a geopolitical conflict rather than addressing their actual, pressing development needs. Officials have been pretty blunt about it: they don’t want to be a “pawn of digital geopolitics.” And they’ve got a point.

Think about the calculus from an African leader’s perspective. You’ve got millions of citizens offline. Your healthcare system’s struggling. Your schools need connectivity. Someone from Washington shows up and says, “Don’t use Huawei,” but offers no alternative financing. Meanwhile, Beijing’s already on the ground with a checkbook open. What do you do? The math’s brutal. Switching from established Huawei infrastructure to Western alternatives—or just refusing Chinese financing entirely—imposes massive, unaffordable costs and delays on digital rollout plans. Delays that directly impact education, healthcare, and economic opportunity for millions of people.

That’s not pragmatism defeating idealism. That’s pragmatism beating ideology because people actually need connectivity.

Which Countries Are Choosing Sides? It’s Complicated

Here’s where most analyses get it wrong. They draw nice, clean maps showing which countries are “Team America” and which are “Team China.” It’s seductive. It’s wrong.

African nations aren’t choosing between the U.S. and China. They’re strategically playing both sides. It’s active non-alignment—a sophisticated strategy that prioritizes African development over external geopolitical interests. And honestly? It’s the smart move.

Strategic Approaches Across the Continent

The Reality Check:

Infrastructure-Leaning on China: Nigeria, Ethiopia, Zimbabwe—these nations prioritized rapid, low-cost national fiber-optic infrastructure, e-government systems, sometimes surveillance technology, all packaged with Chinese loans. They view immediate connectivity as a national priority. Chinese financing’s the fastest path there. No ambiguity.

Balanced Strategic Partners: South Africa, Kenya, Egypt—these are the sophisticated players. They accept Chinese infrastructure loans and work with Huawei on telecom networks while simultaneously welcoming U.S. cloud service providers (Microsoft, Amazon) and attracting significant American venture capital. Diversification reduces dependency on any single power and lets them benefit from both models. They’re not hedging bets; they’re executing strategy.

Security-Oriented Western Alignment: Here’s the thing—this group’s tiny in Africa. Eswatini’s the notable exception. Most African countries aren’t prioritizing Western security and governance standards for core ICT infrastructure, partly because it requires either significant Western financial support or a pre-existing strategic alliance. It’s a luxury choice, and development needs typically override luxury.

Public Opinion Tells a Fascinating Story

The influence battle’s remarkably close. A 2023 Gallup report found that 58% of surveyed Africans viewed China as the most influential global power, slightly edging out the U.S. at 56%. That’s almost a tie. Both powers have substantial soft power on the continent.

But here’s where it gets interesting. Ask people about governance preferences—a 2020 Afrobarometer survey across 18 African countries found 32% of respondents preferred the U.S. democratic model compared to 23% for China’s governance approach. Same people. Different answers.

This apparent contradiction reveals something crucial about African thinking: They appreciate and rely on Chinese infrastructure while still preferring Western democratic values and governance principles. They’re not choosing between two complete systems. They’re pragmatically selecting tools from each based on immediate needs and long-term values. It’s complicated, but it’s not confused.

Table: Comparing Digital Models

| Aspect | China’s Model | U.S. Model |

|---|---|---|

| Focus | Physical infrastructure (hardware/networks) | Software, cloud, startup capital |

| Financing | State-backed loans, concessional rates | Private sector investment |

| Ease | Turnkey, quick rollout | Higher policy and technical requirements |

| Benefits | Rapid access, affordability | Trust, data security, governance |

| Risks | Surveillance, dependency | Entry barriers, slower buildout |

Continental Strategies and Homegrown Innovation

Africa’s path forward isn’t just about managing foreign rivalry. Increasingly, pan-African initiatives are amplifying local capacity to set the rules:

- Smart Africa Alliance: With over 40 member nations, this initiative aims for affordable broadband, harmonized ICT policy, data governance, and creation of a digital single market by 2030. Pillars include policy, access, e-government, private sector innovation, and skills building.

- African Continental Free Trade Area (AfCFTA): The AfCFTA is embedding digital integration into continental trade, supporting initiatives to digitize customs, finance, and market access for SMEs, streamlining digital trade through harmonized rules and a single market.

- AU Digital Transformation Strategy (2020–2030): The African Union’s strategy prioritizes digital infrastructure, local innovation ecosystems, cybersecurity frameworks, and policies for regional digital integration and self-determination.

By investing in digital skills, building local startups, and strengthening governance capacity, Africa aims to reduce dependency. Experienced countries—like Rwanda and Nigeria—are already fostering regulatory environments that encourage homegrown innovation and attract multiple sources of funding.

Economics vs. Security: The Real Policy Tradeoffs

Here’s where African policymakers earn their money. They’re stuck between two sets of priorities that usually point in completely opposite directions.

The Economic Case for Chinese Infrastructure

Developmental Urgency: Affordable financing and rapid construction are essential—not nice to have, essential—to unlock the digital economy and lift millions out of poverty. China’s willingness to finance 70% of a country’s 4G buildout at competitive rates represents a transformational opportunity that cash-strapped African treasuries simply can’t reject. It’s the difference between getting people connected in two years versus fifteen.

Trade Realities: China’s Africa’s largest single trading partner. African governments are deeply invested in maintaining those relationships. Rejecting Chinese technology strains broader economic partnerships and creates ripple effects across multiple sectors. It’s not just about telecom; it’s about the entire economic relationship.

The Numbers Don’t Lie: With only 35% of Africans having internet access, hundreds of millions remain disconnected from economic opportunity, education, and healthcare services. That’s not an abstract problem. That’s real people whose lives could literally change with connectivity.

The Security Case for Western Standards

Data Sovereignty’s Real: State-backed surveillance and espionage represent genuine risks, particularly for sensitive e-government data, financial systems, and citizen information. If a foreign power exploits backdoors in your critical infrastructure, you’ve got limited recourse. That’s not paranoia. That’s security architecture.

Cybersecurity and Trust Matter: Technology from partners with transparent governance and privacy laws offers greater protection against state-sponsored cyberattacks. The catch? This advantage only materializes if paired with robust governance frameworks. You need the whole package.

The Vulnerability Gap: Here’s the uncomfortable truth. Africa lacks foundational legal and regulatory infrastructure to protect itself either way. Without comprehensive data protection laws, cybersecurity regulations, and IP frameworks, African nations are vulnerable regardless of which technology they adopt. And get this—96% of cyber incidents on the continent go unreported or unresolved. That’s not just a number. That’s a systemic institutional failure. No detection capability. No response frameworks. Nothing.

It’s like buying a security system when your house doesn’t have walls yet.

The Path Forward: Transcending the False Choice

Here’s the thing nobody wants to say: African nations face a profound vulnerability. Without sufficient funding, expertise, and time to develop their own tech, they must rely on external powers. China offers cash and hardware to build the “roads.” The U.S. offers the “cars” and “traffic laws” of the internet.

But this framing? It treats African nations as passive recipients. And they’re not.

Recent analysis suggests something more hopeful: African governments face a false choice between digital sovereignty and economic growth. Smart localization strategies combined with regional coordination can achieve both simultaneously. You don’t have to sacrifice growth for security. You just need to be strategic.

As Kazeem Oladepo, COO of IHS and 2025 Conference Chairperson, emphasized: “Africa’s digital trajectory is being shaped now. Connectivity, compute, and capital will decide whether the continent captures the value of its own digital future. We must take advantage of this window of opportunity.” He’s right. The window’s open. It won’t stay open forever.

Building Genuine Digital Sovereignty

To actually achieve digital sovereignty, Africa must move beyond receiving foreign technology to developing its own continental governance standards and investing in local digital skills and innovation. Otherwise, you’re just trading one form of external dependence for another. Same problem, different master.

Continental Governance Frameworks: The African Union’s working to establish common standards for data governance, digital rights, and cybersecurity. These frameworks would create a baseline of protection that doesn’t depend on any single external power. It’s unglamorous infrastructure-building, but it’s foundational.

Local Innovation Ecosystems: Here’s what gives me hope. Africa’s got a thriving startup scene. Local innovation’s possible. By investing in digital skills training, supporting local tech champions, and creating regulatory environments that encourage innovation, African nations can gradually reduce their dependence on external technology providers. Rwanda’s done this. Nigeria’s doing it. It’s not sci-fi; it’s happening.

Diversification as Strategy: Rather than picking a single ally, African nations can strategically leverage competition between the U.S. and China to negotiate better terms, access more capital, and maintain freedom of action. This requires skilled diplomacy, technical expertise, and a clear vision of national priorities. It’s sophisticated, but it works.

Building Institutional Capacity: Creating independent, professional institutions capable of evaluating technology, managing cybersecurity, and enforcing data protection laws—that’s essential. It requires investment in technical training, institutional development, and professional cybersecurity expertise. You need people who actually understand what they’re doing, not politicians making tech decisions.

Africa’s Digital Future Is Africa’s to Shape

Can Africa achieve true digital sovereignty?

Here’s what I actually believe: African nations increasingly understand their own strategic importance and are asserting their own agenda—digital sovereignty and self-determination. They’re not being forced into a new Cold War alignment. They’re writing their own playbooks, using competition between superpowers to accelerate their development on their own terms.

The future looks promising because African countries are refusing to be boxed in. They’ll continue employing diversification strategies. Chinese money for fiber optic cables. American venture capital for startups. Huawei infrastructure. Microsoft cloud services. But most importantly? They’re developing their own capacity and frameworks to govern their digital futures.

African nations are discovering they can leverage this great power competition to negotiate better terms, attract more investment, and accelerate their digital transformation—not as pawns, but as strategic players maximizing their interests. The window of opportunity is now open. The next decade could see Africa not just as a consumer of global technology, but as a co-creator of new norms for digital development, governance, and innovation.

The momentum’s building. African nations have every reason to be optimistic about charting their own course. Africa’s digital race isn’t about which external power wins. It’s about ensuring Africa wins.

And that’s a race worth running.

Also, read how AI is changing the Smartphone experience